Discover why cloud-based payroll software for larger companies is essential. And how CloudPayroll delivers efficiency, scalability, security & seamless integrat

Learn how to choose payroll software for your Australian business. Compare features, costs, and vendors to find the best payroll systems for growth.

Discover how payroll data analytics can improve decision-making, reduce labour costs, and unlock workforce insights to fuel smarter business growth.

Discover how integrated payroll systems streamline admin, boost accuracy, and connect payroll with HR and accounting. Learn how CloudPayroll makes it simple.

Uncover how easy it is to switch payroll systems without interruption with CloudPayroll’s comprehensive transition process.

Discover the hidden costs of inefficient payroll. Learn how to enhance payroll efficiency and streamline processes with CloudPayroll today.

Australian based CloudPayroll and New Zealand's iPayroll are trusted payroll software platforms that work in tandem to streamline multi-country payroll.

CloudPayroll offers several features to streamline the process of managing the differing payments to employees and contractors to keep it simple.

We understand the challenge of transitioning to a new payroll solution and designed a comprehensive transition process ensuring a smooth change for our clients.

Payroll management stands as a critical business function that demands precision and efficiency.

Discover the STP exemption for WPN employers. Learn about ongoing payroll responsibilities and the benefits of voluntarily adopting STP with CloudPayroll.

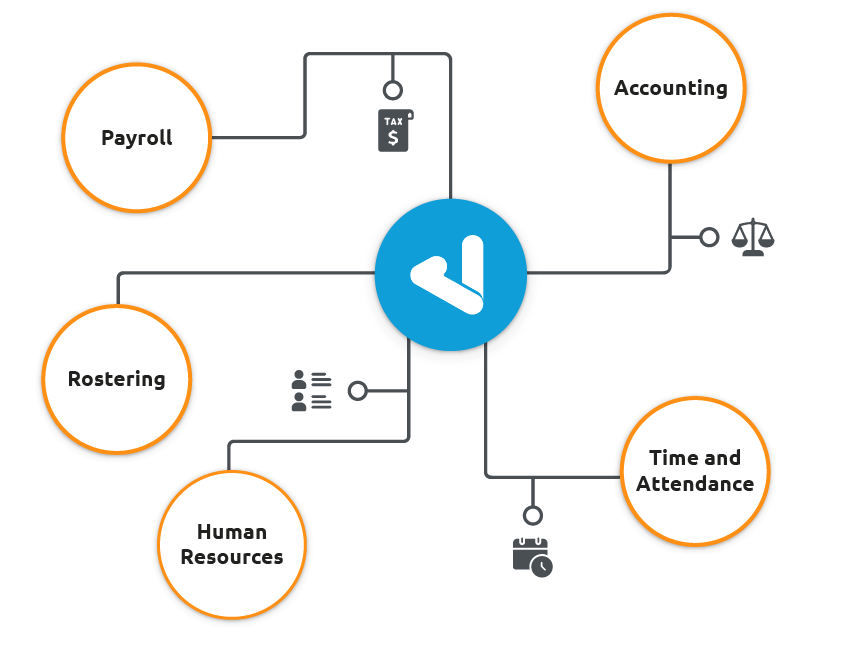

You can use CloudPayroll in conjunction with other integrated applications to streamline your business processes.

The government has announced the expansion of Single Touch Payroll (STP) to include additional reporting information.

CloudPayroll has created several great tools to support clients by ensuring the processing of JobKeeper payments is quick and easy.

Two Factor Authentication, often referred to as two-step verification, is an extra layer of security.

Simplify NDIS payroll for self-managed participants. Pay carers, manage PAYG, super, timesheets, and ATO reporting with CloudPayroll’s easy software.

Discover the benefits of payroll software for your business. Save time, cut costs, stay compliant, and simplify payroll with cloud-based payroll tools.

ATO Small Business Superannuation Clearing House is closing. Learn what small businesses must do, deadlines, and how to transition smoothly with CloudPayroll.

Keep payroll data secure and compliant. Discover how to protect sensitive employee information and meet Australian privacy laws with CloudPayroll.

Get ready for the July 2026 changes with Payday Super. We discuss what Payday Super means for Australian employers, how it works, and when Payday Super starts.

Discover the benefits of employee self-service payroll. Empower staff to access payslips, update details, and manage leave with CloudPayroll’s Kiosk app.

Simplify payroll management with these key employer responsibilities and best practice tips. Learn how CloudPayroll can streamline your payroll processes.

Uncover the best payroll management strategies and software solutions for both larger and small businesses tailored to your company size. Find your perfect fit!

Explore payroll technology trends for 2025. From mobile accessibility to advance reporting, discover payroll management innovations for Australian businesses.

Read how CloudPayroll can help your business reduce manual payroll processing admin and increase accuracy.

CloudPayroll can streamline the management process for organisations who offer TOIL which can benefit employees and employers.

A checklist of helpful questions to assist when evaluating a payroll solution to determine the best fit for your business needs.

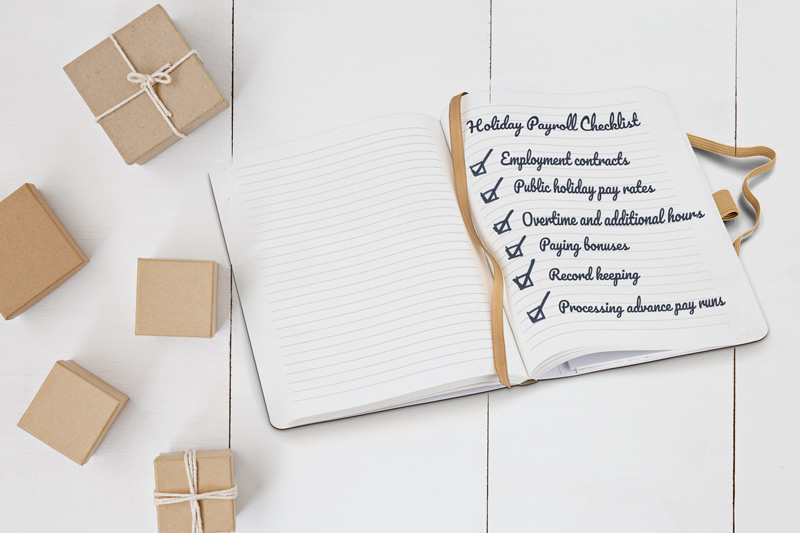

CloudPayroll’s holiday payroll checklist to assist with smooth payroll processing over the upcoming holiday period.

By integrating with a variety of rostering, time and attendance, HR and accounting applications you can build an ecosystem to meet your specific business needs.

The National Employment Standards (NES) provide casual employees with a pathway to becoming permanent employees. This is known as ‘casual conversion’.

A Withholding Payer Number (WPN) is allocated to individuals, and some non-individuals, who do not have an Australian Business Number (ABN).

From 1 July 2021, employers must report payments made to closely held payees through STP.

Find out more about our seamless process of migrating your payroll from Xero to CloudPayroll.

Discover how employee time tracking software like Timelogs helps you log hours, reduce admin, and simplify payroll with CloudPayroll’s smart tools.

CloudPayroll empowers employees by giving them an easy way to manage their time off.

Employee HR information can be easily uploaded, stored and accessed in CloudPayroll.

CloudPayroll Australia © 2023 - All rights reserved