No ABN. No problem. CloudPayroll makes STP, PAYG, and superannuation simple for WPN users.

The ATO issues a WPN to individuals and some organisations that need to withhold tax (PAYG) but don’t have an Australian Business Number (ABN). WPNs are commonly used by:

If you’re paying wages under a WPN, you have obligations, including Single Touch Payroll (STP) reporting (not compulsory), PAYG withholding, and superannuation. CloudPayroll can help, to learn more check out our Guide to Payroll for WPN Holders.

Whether you’re a first-time employer or supporting someone through the National Disability Insurance Scheme (NDIS), CloudPayroll simplifies payroll from start to finish. Our powerful features save you time, cut down on errors, and give you confidence that payroll is done right. With automation, secure reporting, and friendly local support managing WPN payroll has never been faster, or easier.

Setting up payroll for the first time can feel overwhelming, but with CloudPayroll, you're never on your own. Our dedicated local Implementation Team will configure your account specifically for WPN use, ensuring all tax, super, and employee settings are correct from day one. Our local knowledgeable Support Team is available, with free, unlimited help via phone or email whenever you need it.

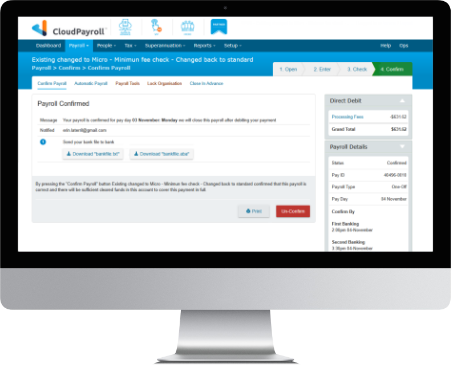

CloudPayroll takes care of Single Touch Payroll (STP) and PAYG reporting automatically, every time you run a pay. Your payroll data is securely lodged with the ATO in real time, no extra steps required. We use the latest ATO tax tables to calculate your withholding amounts accurately and generate clear reports to keep your records in order.

Super payments are SuperStream compliant and can be processed monthly via our optional clearing house. Leave entitlements, such as annual, sick, or long service leave, are tracked automatically. Employees can view their balances and submit leave requests online via their Employee Kiosk, which flows directly into payroll once approved.

Need a way to track hours worked? Enable Timelogs, and employees can enter start and finish times or total hours through our app or browser. The system calculates hours automatically, and managers can approve entries with a single click. You can also code time entries to jobs, roles, or cost centres for more detailed reporting.

CloudPayroll is purpose-built for individuals and organisations using a Withholding Payer Number (WPN) instead of an ABN. Our system manages every compliance requirement, from STP and PAYG to super and leave, in one user-friendly platform. No need for spreadsheets, third-party tools, or payroll guesswork.

WPN holders across Australia trust CloudPayroll because we make payroll simple, secure, and fully compliant. Whether you're hiring domestic help or supporting someone through the NDIS, CloudPayroll is the easy choice for confident payroll management.

CloudPayroll Australia © 2023 - All rights reserved