We provide an easy-to-use, feature-rich payroll solution so your focus can be on your business.

CloudPayroll is an intuitive, proven, cloud-based payroll solution suitable for a small business with one employee up to an enterprise business with several hundred employees, or a group of businesses and franchises, in any industry.

Based in Australia CloudPayroll’s friendly and experienced Support Team are instantly available via phone or email to answer your payroll questions, for no additional fee.

Our comprehensive reporting suite includes 50+ reports including financial, HR, leave and tax. Choose between displaying reports online or downloading in a choice of formats.

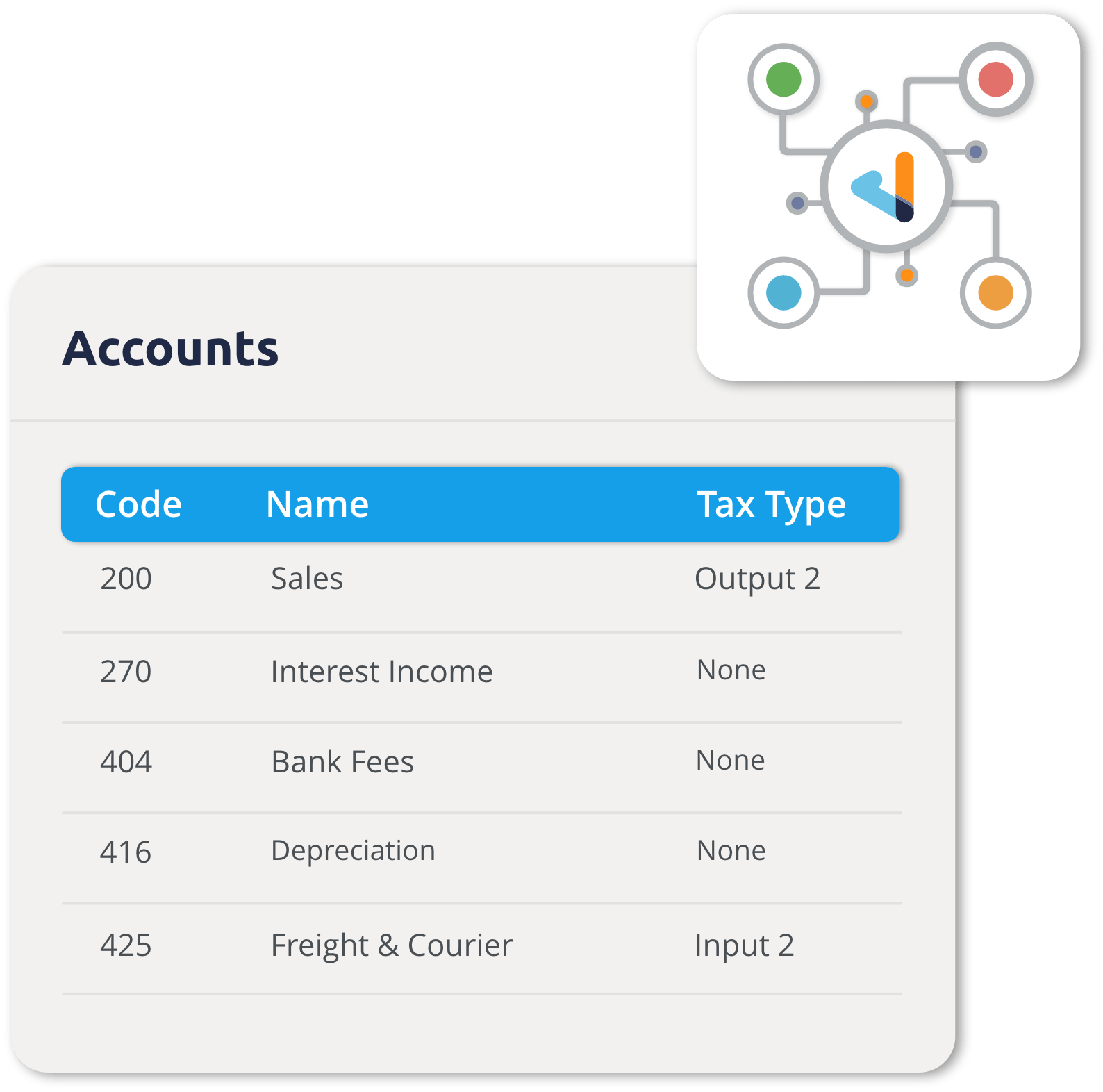

Integrate CloudPayroll with a variety of other trusted and established software solutions to create an ecosystem best suited to your business. View our full list of integration partners.

Are you starting out today with 10 employees and planning to have 200+ employees in five years? Take us with you and we'll ensure you always have the right payroll solution. CloudPayroll has the solution for businesses of all sizes in any industry.

Sign up

CloudPayroll Australia © 2023 - All rights reserved